Homeownership as an Investment

A home can be one of the most significant investments you make in your entire lifetime. A home is a place where you can store your personal property, have freedom to live your own lifestyle, raise a family, and accumulate wealth in the time you are enjoying those benefits.

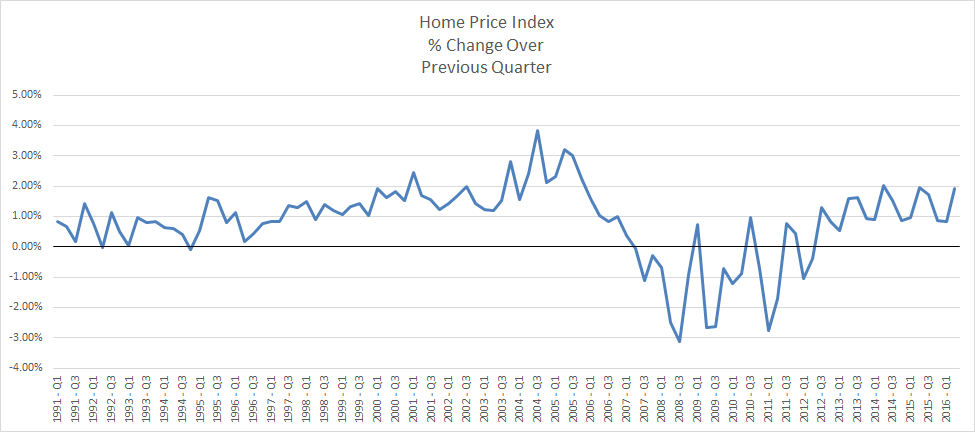

Below is a chart of how the Home Price Index has changed on a quarterly basis over the past 15 years. The Home Price Index is a broad home price measurement across various geographical locations, which is produced by the Federal Housing Finance Agency.

As you can see, home prices have moved upwards (I.e. any quarter above the black line) the large majority of the time. Out of the 102 quarters in this chart, home prices declined in value in only 19 of them. This data includes the late 2000's as well, which was the worst housing crisis the US has ever seen. As an example, if you bought an average US home in 1991 for $100,000 and held it through the worst housing crisis in US history, it would be worth around $234,000 today.

Should I rent or should I buy a home? This is a question that most people will eventually come to in their adult lives. There are many things to consider before making this difficult decision. It is not as simple as comparing monthly rent payments with monthly mortgage payments. When you own a home, you must consider property taxes, property insurance, homeowners association fees and maintenance costs. Maintenance costs can be extremely expensive and are often underestimated by homeowners. You must seriously weigh these factors before making the leap from renting to buying a home.

The main benefit of buying a home, rather than renting, is the fact that you will build equity in your home to increase the value of your investment over time. Let's go over a quick example to see how much money you could save by buying instead of renting.

Let's start by using the average cost of a US home (about $200,000) and the average cost of US rent (about $1,000 per month). Also, buying a new home requires a down payment, usually between 10% and 20%. Let's assume a 20% down payment to be safe. Let's also assume that it is a 30-year mortgage. You can see how we set up the rest of the calculation in the image below.

We used a very modest home appreciation of 2%, but you can see from the example in the previous section that home prices can appreciate much faster than 2% a year. In this very modest example, you would break even after 10 years of homeownership. After 15 years, you would have saved $16,586 ($92 per month) and you would be able to sell your home for $269,175. So, you would not only save more money than the renter, you would be able to sell your home for a nice profit, which is something a renter would never be able to do.

When considering homeownership as an investment, make sure that you intend to stay in your home for at least five years and that you will continue to make a steady income to pay your mortgage during that period. You should also make sure that the home is in a location that you will be happy with for a while. Shop around to find a home that perfectly suits your needs. If you are in a stage of your career where you may be required to move around a lot, homeownership may not be the best investment for you. Consider all the extra work and expenses that homeownership requires. Renting will get you used to people paying for and fixing things that make your living situation comfortable. Homeownership requires you to spend the money and make the effort to keep your residence in nice condition. If you are willing to make the sacrifices and put the necessary time in, you can reap the rewards of a great investment.

According to US Census Bureau statistics, home equity makes up the majority of American’s net worth. In fact, a staggering 73% of total net worth comes from home equity. Adults under 35 years old is the only age group where total net worth is not made up primarily of home equity. As people get older, and presumably their homes appreciate, home equity makes up a higher and higher portion of their overall net worth. If you have considered all the responsibilities of owning a home and you are ready to make a long-term investment, homeownership could be a great way to build wealth.